Latest News

-

Ireland’s NAERSA urged to scrap 13-week lookback exemption plan for occupational schemes

-

€80m worth of contributions collected for Ireland’s MyFutureFund since launch

-

Danish pension proposal risks undermining retirement savings, I&P Denmark warns

-

Gender pension gap narrowing among SPK members

-

Athora receives regulatory approval for PIC acquisition

-

Revised SFDR continues to ‘insufficiently’ reflect IORP characteristics – PensionsEurope

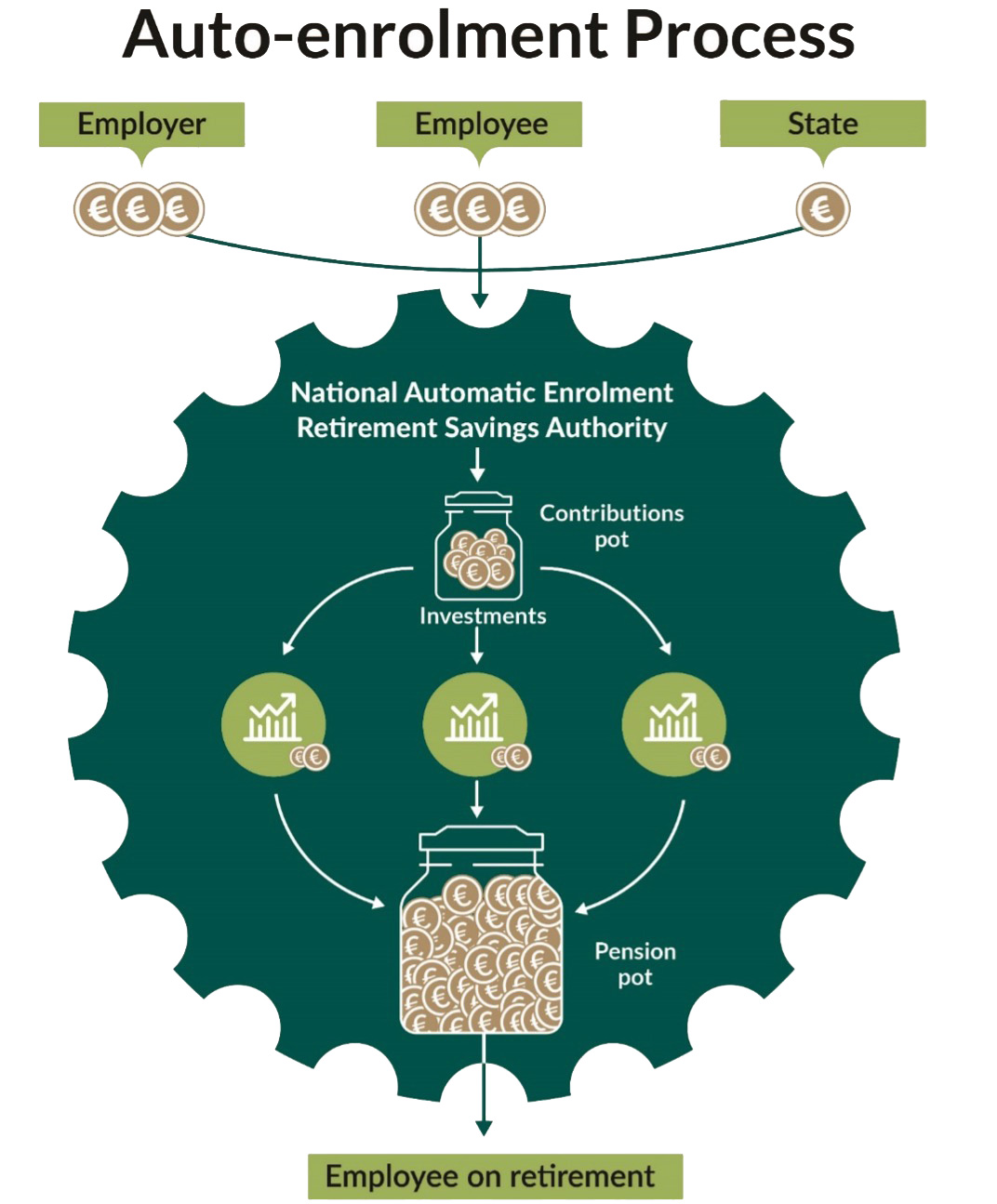

Ireland's National Automatic Enrolment Retirement Savings Authority (NAERSA) has been urged to replace its proposed 13-week lookback assessment for occupational pension scheme exemptions from MyFutureFund with an overall scheme quality test, assessing the total value of benefits over a period of at least one year.

Irish Association of Pension Funds (IAPF) chief executive, Joyce Brennan, and Irish Institute of Pensions Management (IIPM) president, Aaron Gaynor, called for the change in a letter to NAERSA chief executive, Dermot Griffin, following a meeting they had where they initially raised the proposal

Check out our latest news

Latest Podcasts

Podcast: Stepping up to the challenge

In the latest European Pensions podcast, Natalie Tuck talks to PensionsEurope chair, Jerry Moriarty, about his new role and the European pension policy agenda

Podcast: The benefits of private equity in pension fund portfolios

The outbreak of the Covid-19 pandemic, in which stock markets have seen increased volatility, combined with global low interest rates has led to alternative asset classes rising in popularity. Private equity is one of the top runners in this category, and for good reason.

In this podcast, Munich Private Equity Partners Managing Director, Christopher Bär, chats to European Pensions Editor, Natalie Tuck, about the benefits private equity investments can bring to pension fund portfolios and the best approach to take.

In this podcast, Munich Private Equity Partners Managing Director, Christopher Bär, chats to European Pensions Editor, Natalie Tuck, about the benefits private equity investments can bring to pension fund portfolios and the best approach to take.

Podcast - The power of three: Using Common Contractual Funds to improve tax outcomes for investors

Large asset owners are still investing in equities in a way where they are taxed on their income. The implication is that they get a poorer return. They need to, and can, improve this, but how?

In this podcast, AMX Head of Client and Manager Development, Aaron Overy, and AMX Product Tax Specialist, Kevin Duggan, discuss with European Pensions Editor, Natalie Tuck, about three options to help ensure good withholding tax outcomes for institutional investors.

In this podcast, AMX Head of Client and Manager Development, Aaron Overy, and AMX Product Tax Specialist, Kevin Duggan, discuss with European Pensions Editor, Natalie Tuck, about three options to help ensure good withholding tax outcomes for institutional investors.

Check out our latest appointments

Check out our latest features

Podcast: Stepping up to the challenge

In the latest European Pensions podcast, Natalie Tuck talks to PensionsEurope chair, Jerry Moriarty, about his new role and the European pension policy agenda

Podcast: The benefits of private equity in pension fund portfolios

The outbreak of the Covid-19 pandemic, in which stock markets have seen increased volatility, combined with global low interest rates has led to alternative asset classes rising in popularity. Private equity is one of the top runners in this category, and for good reason.

In this podcast, Munich Private Equity Partners Managing Director, Christopher Bär, chats to European Pensions Editor, Natalie Tuck, about the benefits private equity investments can bring to pension fund portfolios and the best approach to take.

In this podcast, Munich Private Equity Partners Managing Director, Christopher Bär, chats to European Pensions Editor, Natalie Tuck, about the benefits private equity investments can bring to pension fund portfolios and the best approach to take.

Mitigating risk

BNP Paribas Asset Management’s head of pension solutions, Julien Halfon, discusses equity hedging with Laura Blows

© 2019 Perspective Publishing Privacy & Cookies